In the rapidly evolving world of financial technology, mobile devices have become crucial connection points between customers and services. From self-service kiosks in bank lobbies to mobile payment terminals in retail stores and smart ordering machines in campus cafeterias, these devices—consisting of Android Devices in Finance and Kiosk machines—are profoundly changing our lives. However, for FinTech companies providing these services, the challenge of managing these devices securely and efficiently while ensuring the stability of core applications is a growing concern. As device fleets expand from 100 to 200 units or more, traditional manual management methods are no longer viable.

This is where the value of a powerful FinTech MDM solution comes into play.

1 FinTech Device Management Pain Points

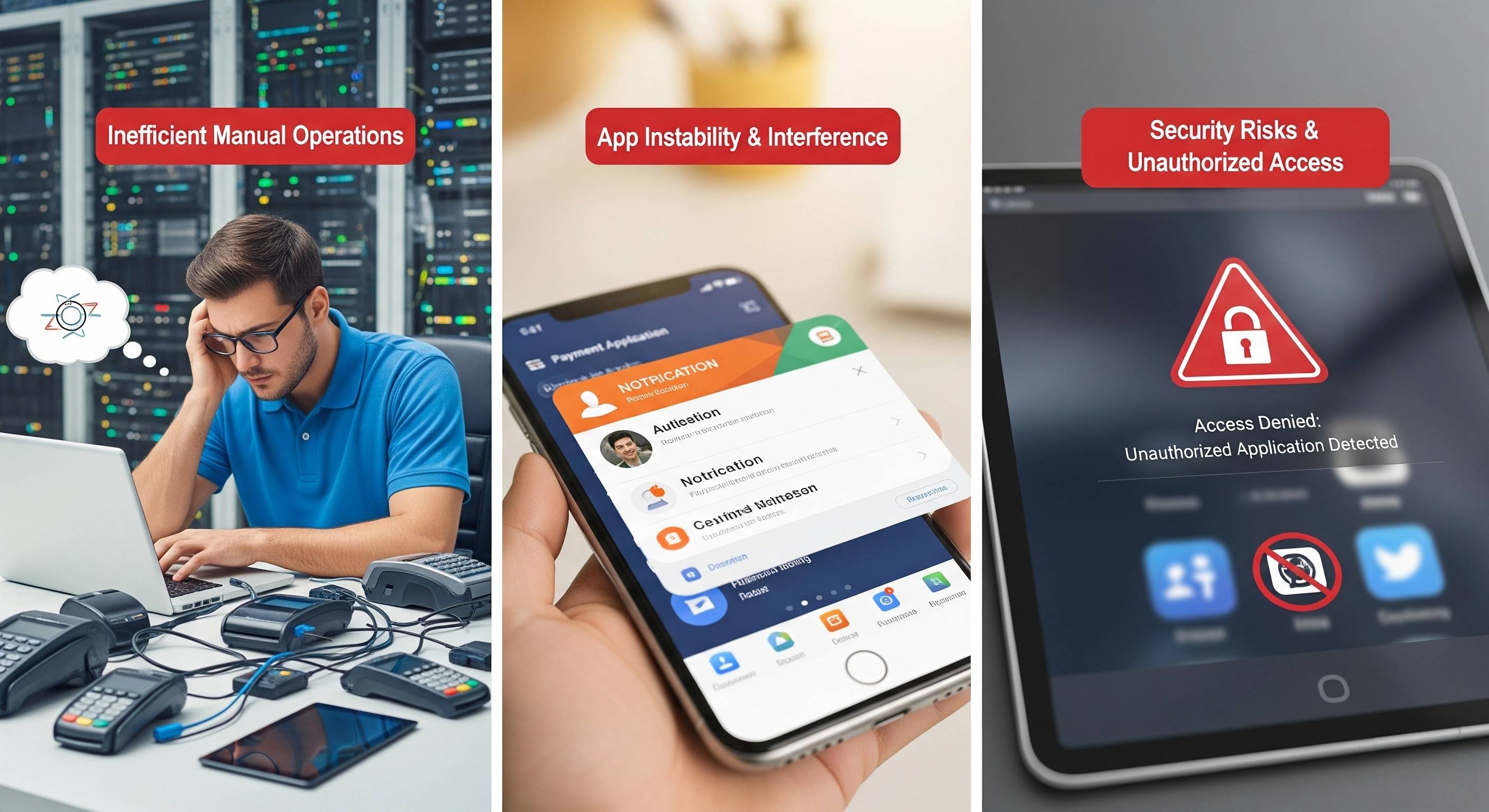

The demands for FinTech device management are extremely stringent, where any oversight can lead to significant operational and security risks. The challenges are particularly acute in Banking Device Management and Financial Services Tablet Management:

- Inefficient Manual Operations: With devices scattered across different locations, every app update or configuration change requires IT personnel to perform manual, device-by-device operations. This inefficient model is not only time-consuming and labor-intensive but also makes it difficult to ensure consistent app versions across all devices, negatively impacting the user experience.

- Threats to Core Application Stability: Critical applications for payments and ordering must always run in the foreground. In public usage scenarios, users may accidentally exit the app, or other programs could push the core application to the background, interrupting the service.

- Security and Compliance Risks: Public-facing devices are at risk of being used for non-work purposes, which not only consumes network resources but can also lead to data breaches. A lack of effective policy restrictions allows users to change network settings, causing devices to fall out of management control and posing a serious threat to Mobile Device Security for Banking.

2 AirDroid Business: The MDM Solution Built for FinTech

As a professional MDM for Self-Service Terminals solution, AirDroid Business provides FinTech companies with a comprehensive, highly efficient toolkit designed to solve these core pain points. It empowers companies to focus on core business innovation without worrying about device management.

- Automate App Deployment, Eliminate Manual Work (AMS): With the powerful FinTech App Deployment (AMS) feature, you can bulk-push core payment apps or other custom applications to all devices. Whether it's for initial installation or version updates, AMS enables remote and automated management, ensuring all devices run the latest, most stable app version and drastically improving IT operational efficiency.

- Lock Down Core Apps for Uninterrupted Service (Kiosk Mode): Using its unique Kiosk Mode for Banking Apps, AirDroid Business can lock devices to a single application or a pre-set selection of apps, such as your payment app. This completely eliminates the risk of apps being accidentally exited or switched, ensuring the device remains in a ready-to-work state and provides a smooth, uninterrupted service experience for users.

- Fortify Security, Prevent Unauthorized Use (Policy Management): Through flexible Policy Management, you can easily restrict device permissions. For example, you can disable the Google Play Store to prevent users from installing other apps, restrict access to inappropriate websites, or lock Wi-Fi settings to keep devices on a controlled network. This not only ensures device compliance but also reduces the risk of data breaches.

- Innovative Marketing: Put Idle Devices to Work (Media Screensaver): Beyond basic management, AirDroid Business offers an innovative Media Screensaver feature. When devices are idle, you can remotely push and play custom images or videos, turning them into digital billboards for brand promotion or information dissemination, transforming devices from simple tools into effective marketing channels.

3 Success Stories: How FinTech Companies Are Upgrading Efficiency and Security

AirDroid Business solutions have been successfully implemented across various FinTech scenarios:

- Campus Payment Solution Provider: This FinTech company deployed over 100 self-service Kiosk machines in a student cafeteria. They faced pain points like time-consuming manual app updates, app instability, and unauthorized device setting changes. By introducing AirDroid Business, they used FinTech App Deployment (AMS) to automate app updates, utilized Kiosk Mode for Banking Apps to lock down the ordering app for service fluency, and leveraged Policy Management to create Secure FinTech Kiosks, ensuring the devices were safe and controllable.

- Major Commercial Bank: A large commercial bank deployed hundreds of tablets at its service desks for customer account opening and transaction processing. To ensure data security and focus, the bank used the Kiosk Mode for Banking Apps from AirDroid Business to lock the devices to specific internal banking applications, preventing employees from using non-work apps. Additionally, with remote control features, the IT department could diagnose and fix device issues instantly without a physical visit, significantly improving operational efficiency and ensuring business continuity.

- Insurance Company's Mobile Sales Team: An insurance company equipped its hundreds of field sales agents with tablets for client visits and contract signing. These mobile devices were at high risk of being lost or stolen. By deploying AirDroid Business, the company excelled in Insurance Agent Tablet Management: using FinTech App Deployment (AMS) to ensure all sales apps were on the same version, utilizing Geofencing to trigger alerts when devices left designated areas, and enabling remote lock/wipe features to instantly protect sensitive client data if a device was lost, ensuring both data security and compliance.

4 Seize the Future: Choose a Dedicated MDM for FinTech

In today's highly competitive FinTech landscape, efficient device management is no longer optional—it's a critical factor for service quality and business success. AirDroid Business's dedicated MDM for Self-Service Terminals solution not only helps you solve immediate management pain points but also uses powerful automation and security capabilities to protect your business and help you gain a competitive edge in the new era of digital finance.

AirDroid Business - Android Device Management

AirDroid Business is an Android device management solution that can be used to enroll, manage, and monitor large fleet devices. With the centralized platform, organizations are able to deploy smartphones, tablets, rugged devices and others dedicated devices like kiosks and digital signage.

It's available for Cloud Deployment & On-Premises Deployment.

Key features include: remote access & control, Google Play apps & enterprise's apps management, policy, single & multi-apps kiosk mode, alerts & automated workflows, geofencing & location tracking, file transfer, notification, user management, reports, etc.

Leave a Reply.